Rocket Companies is edging into fintech with its acquisition of personal financial app Truebill. In looking to diversify his company beyond mortgage services as well as reach a higher trading multiple for its stock, Rocket Chief Executive Officer Jay Farner is attempting to kill two birds with one stone by tapping into the thriving fintech sector.

Rocket will pay $1.275 billion in cash for Truebill, which was founded in 2015 and has built up a member base of over 2.5 million using its innovative platform to manage bills, subscriptions, and budgets. Truebill analyzes $50 billion in transaction volume per month as of now, and has saved consumers upwards of $100 million in its six years of operation. Following a $45 million capital raise in June 2021, Truebill reached a valuation of $500 million. The upward trajectory of its value is indicative of the surging fintech market as well as the seemingly limitless potential for larger companies to purchase hot-commodity startups to shrewdly augment their portfolios. Deals such as Intuit's $12 billion Mailchimp and $8.1 billion Credit Karma acquisitions further reflect this trend.

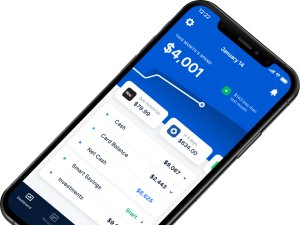

Farner explained his affinity for the offerings of Rocket's newly acquired asset, saying, “We are very impressed with what Truebill has created—providing a simple, intuitive client experience to help its users save significant money. The company is a perfect fit for the Rocket platform. Truebill’s work helping Americans keep track of their finances and providing guidance that leads to better financial outcomes follows the same philosophy as Rocket Companies—leveraging the power of technology to remove the friction from complex transactions—and applies it to everyday life."