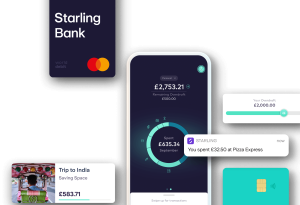

It’s hard to imagine a digital bank better positioned to break into Europe than U.K. fintech Starling. With more than three million clients, a $3 billion valuation earlier this year, and major investments by Goldman Sachs and other significant parties, Starling has been pursuing an aggressive campaign to offer its services in Ireland and beyond.

Which might make it all the more surprising that Starling has officially dropped its application with the Irish central bank to expand its business into European markets. After a four-year application beset by delays and setbacks, the digital bank is no longer seeking to bring its popular digital lending services overseas.

Despite the circumstances that led to this reversal, company leadership cast the move in an optimistic light, explaining that the withdrawal is part of better serving Starling’s mission in a changing world. “Ultimately, we felt that an Irish subsidiary would not deliver the added value we are seeking,” said Chief Executive Officer Anne Boden in a memo. “We’ll now be focusing on taking our software to banks around the globe through our Software-as-a-Service subsidiary, Engine, and by expanding our lending across a range of asset classes, including through targeted M&A activity.”