U.S. FinTech Varo is achieving some big goals in 2020.

Founded in 2015, Varo has been offering banking products through The Bancorp Bank, as well as fee-free ATM withdrawals with its worldwide network of more than 55,000 Allpoint ATMs. Customers are not subject to minimum balance requirements or foreign exchange and overdraft fees. During the COVID-19 pandemic, the company also prioritized the processing of electronic and paper check Treasury payments, as well as providing individuals who have direct deposit early access to stimulus and unemployment relief funds. In addition, Varo increased both deposit and ATM limits and accelerated key partnerships with companies, including job platforms Steady and Wonolo.

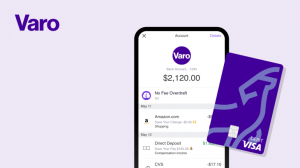

To date, the Varo app has been downloaded over 4.2 million times.

Despite its success, Varo has been focused on becoming an actual bank since 2018, which would enable it to take deposits, pay interest, make loans around the U.S., and issue debit and credit cards via its mobile app. Just last week, Varo announced that it has become the first U.S. consumer FinTech to receive a national bank charter from the Office of the Comptroller of the Currency (OCC), as well as secured regulatory approvals from the FDIC and Federal Reserve. The company will now be able to offer FDIC-insured banking services to the millions of Americans who have been overlooked and underserved by the traditional financial system. They also plan to expand their products and to provide affordable access to credit, easier management of cash flows, and financial resiliency.

“2020 has been challenging for many of us across the country and has highlighted, once again, how the traditional financial system is not meeting the needs of hardworking, everyday Americans. The ability to operate as a full-service national bank gives Varo more freedom to deliver the kind of innovation and allyship that many Americans have never had from their bank before,” said Colin Walsh, founder and CEO of Varo Bank.

This has been a successful year for the company. In June, they announced that they had closed a $241 million Series D round, co-led by new investor Gallatin Point Capital and existing investor The Rise Fund, which was co-founded by TPG, U2 lead singer Bono, and Jeff Skoll, a global entrepreneur, impact investor, and movie producer. Other new investors, including HarbourVest Partners and Progressive Insurance, also participated in the round.