This summer’s dramatic end to the fintech bull market brought an end to countless companies’ plans for expansion as well. From brand-new startups to established companies like Stripe, it seems that everyone has been hastily making changes to their long-term business plans, cancelling announced acquisitions and postponing new borrowing, particularly when it comes to cryptocurrency.

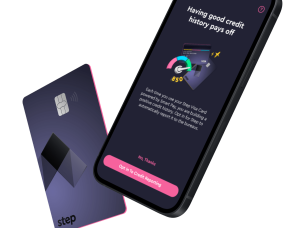

For Palo Alto fintech startup Step, however, it’s still business as usual. In fact, with a new crypto investing feature and a platform user base in excess of four million people, the company is doubling down on its mission to provide crypto investment opportunities to teens and young people, announcing on October 11 that it will be borrowing $300 million in debt financing to move ahead with planned expansion.

As Founder and Chief Executive Officer CJ MacDonald explained in an interview, Step has big plans for that new funding. “We’ve got some other products that we’re going to be launching and having additional capital helps set us up for long-term success,” he said.

The company is no stranger to difficult market forces, having been launched during the COVID-19 pandemic. In its two years of doing business, Step has raised an incredible $500 million in capital, with its latest funding led by TriplePoint Capital and Evolve Bank & Trust.